Starting This Early Can Make You Filthy Rich

To ensure you get the best information, you will find ZERO ads, affiliate links, and sponsored posts on this site. Click here to learn more about my mission.

“If you could only give one piece of financial advice to a person, what advice would you give them?”

I get asked this question a lot, and it’s a pretty easy answer for me. I always say, spend less than you earn. Ask that exact question to any personal finance expert and I bet that 9 times out of 10, they answer the same way.

However, I always want to talk about the second best piece of advice too because I feel that it goes hand and hand with the advice I just mentioned. That advice would be to learn about compound interest.

If you learn about compound interest, I can guarantee that it will encourage you to stockpile that money you are saving from living on less than you earn.

The Basics

Essentially, there are two types of interest: simple interest and compound interest.

With simple interest, you will only earn interest on your initial principal deposit. For example, if you deposit $1,000 in the bank and it earns 5%, you will earn $50 in the first year. In the second year, you are still only earning interest on the initial deposit of $1,000. So, assuming that the interest rate is still 5%, you will earn another $50. If you kept the same $1,000 deposit in the account for 10 years, you would have a total of $1,500 in the bank (10 years of $50 interest payments + the initial $1,000 deposit).

Compound interest is another beast all together. With compound interest, you will not only earn interest on your initial principal deposit but also on any interest that is credited to the account. Using the same example above, if you deposit $1,000 in the bank and it earns 5%, you will earn $50 in interest, in the first year. However in the second year, not only will you earn interest on the principal, you will also begin earning interest on the interest in the account. So, in year 2 the 5% interest will be credited against the full $1,050 you have in the account and your total interest for year 2 would be $52.50. Pretty sweet!

If you kept the same $1,000 deposit in the account for 10 years, you would have a total of $1,628.89. That is an increase in $128.89 from the simple interest calculation. You may be saying to yourself, “so what Adam, it’s a measly $128.89 over 10 years”. Well you’re right, it is. However, when you look at compound interest over 20 or 30 years and with more money, it becomes apparent that it’s a miraculous thing.

Timing Is Everything

As I mentioned above, the longer you are able to let compound interest work in your favor, the better. Since the definition of compound interest is the ability to “earn interest on interest”, the additional interest adds up immensely over time.

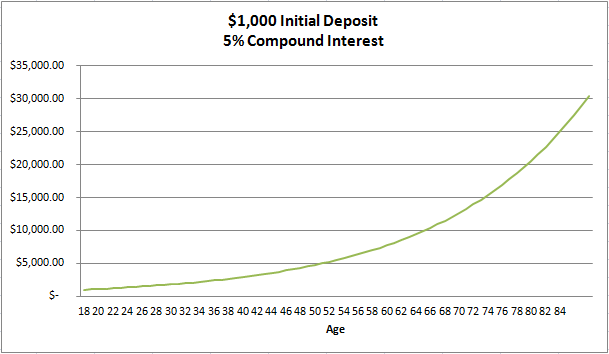

Once again, let’s explore the example used previously. Let’s say that you are wise enough to deposit $1,000 in the bank on your 18th birthday and you miraculously earn an average of 5% annually on the account (I know what is pretty high in these times, but humor me). Let’s also say that over the years, you do not add any additional money to the account and just let it sit. We could even say you forgot about it. By the time you reach age 65, the account will have $7,761.59 in it! The next years interest will be $388.08. That’s a hefty increase from the original $50 in interest you received in the first year. And to think, you didn’t even add another penny to the account! Like I said above, the longer you let compound interest work in your favor, the better. I have created this graph to illustrate that phenomenon.

As you can see from the graph, as the interest begins to accrue in the later years, the account value increases faster every year (hence the sharper incline in the later years). What I’m essentially trying to say is, if you save early on in your life, you won’t have to save as much later.

Saving Early = Saving Less

So, you now have a pretty good idea of how compound interest works. So, I would like to show you how essential it is to save early on in your life.

In this example, I want to introduce you to Responsible Rachel and Procrastinating Pete. They are two completely different people financially and are both 22. Responsible Rachel understands the concept of compound interest and really wants to take advantage of it. She lives on less than she earns and saves the rest. Procrastinating Pete, on the other hand, really wants to enjoy his new income out of college. He spends everything that he makes (and then some). He doesn’t save a penny.

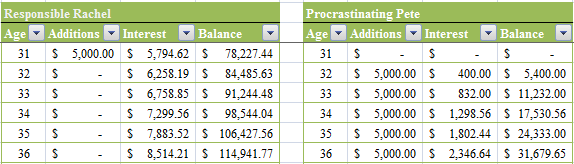

Since Responsible Rachel is so well, responsible, she is able to put $5,000 per year into a Roth IRA (we’ll talk about these is a future post). Let’s also assume that she invests it into a growth mutual fund that averages about an 8% annual return. She does this every year until she reaches 32 when she just decides to stop. In those 10 years, she will contribute a total of $50,000.

After 10 years of messing around, Procrastinating Pete realizes that Social Security isn’t going to be there when he retires. He decides to start contributing to a Roth IRA as well. He too contributes $5,000 a year and invests in the same mutual fund that averages 8% per year. However, he feels that since he got a late start, he would continue to contribute the $5,000 per year until he retires at age 65. Here is a visual of our two savers at age 31 (Rachel’s last contribution and the year before Pete’s first):

As you can see, Responsible Rachel already has approximately $78,227.44 in the account before Procrastinating Pete even puts in a dime. However, in the back of your mind you are more than likely thinking that even though Procrastinating Pete got a late start, Responsible Rachel stopped contributing all together, and there is no way that she will have more at age 65 than Procrastinating Pete because he is still socking away $5,000 a year.

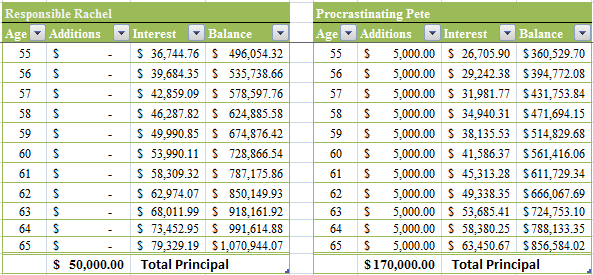

Well, if you are thinking that, you’re wrong. Check out this chart to see what I mean:

At age 65, Responsible Rachel will have a whooping $1,070,944.07 in her account while Procrastinating Pete will only have $856,584.02. That’s a difference of $214,360.05!

You also have to take into account the fact that Procrastinating Pete contributed $120,000 MORE (of principal) into his account than Responsible Rachel did into hers. So, he has $214,360.05 less in his account while contributing $120,000 more. Crazy!

The main thing that I want to hammer home is that the sooner you get started, the more opportunity you have for compound interest to work in your favor.

Be more like Responsible Rachel, and not like Procrastinating Pete.

![]()