How Long Will It Take To Eliminate Your Debt? Use This Get Out of Debt Calculator and Find Out

To ensure you get the best information, you will find ZERO ads, affiliate links, and sponsored posts on this site. Click here to learn more about my mission.

One of the biggest hurdles that people face while eliminating their debt is the commitment that it takes.

For most of you, eliminating your debt isn’t going to be some stroll in the park.

It’s going to take time. Things are gonna have to change. You and your family will have to learn to live without some luxuries that you may have grown accustomed to.

That might be a tough pill to swallow right now, but I want you to think about what your life would be like without debt. How much could you save on a monthly basis? How would a lack of financial stress change your life? How would your marriage and friendships change?

These are the things that you have to keep reminding yourself of as you are attacking your debt. It will help solidify the commitment and keep you dedicated to the cause.

While we’re on the subject of committing to eliminate your debt, hopefully you’ve had a chance to review some of the methods for getting out of debt and determined your battle plan. If not, you might want to give that article a quick read. I’m going to pull some of the examples from there for today’s article.

Time and Money

You probably already know what your debt is costing you now and if you don’t, I highly recommend finding out. But how much is it going to cost you before you’re completely out of debt? In fact, how long is it actually going to take you to dig out?

Well, it’s time to put your debt elimination battle plan into full gear and attack this beast head on.

For this exercise, you’re going to use a debt reduction calculator to determine just how your plan is going to work. The calculator will help you determine the following:

- How long it will take you to eliminate each debt

- How long it will take you to get out of debt completely

- How much interest you will pay in total

Of course, all of these things are dependent on your sticking to the plan. That’s the tough part! 🙂

I’m going to provide examples that show you how the calculator works as well as the results based on the sample debts that were from the article on the methods to get out of debt.

Here’s a link to the calculator I use.

How The Get Out of Debt Calculator Works

In order to use the calculator, you’ll need the following information regarding your debts:

- Total Balance

- Annual Interest Rate

- Minimum Payment

- Your “Extra Payment” Amount From Your Budget

The calculator has all three of the methods that were discussed built in. You just need to enter in your debts, select the method that you’d like to use and see the results.

Let’s go over the steps for determining how much your debt is costing you.

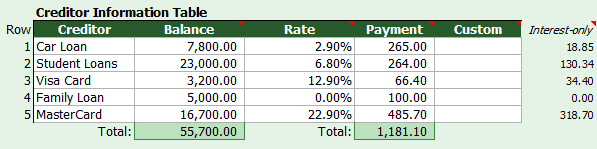

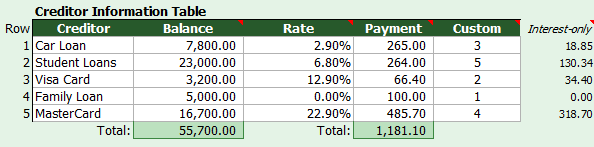

For illustration purposes, I am going to use the example debts from the post on the methods. Here are the example debts again:

- $7,800 Car Loan @ 2.9% – $265 Minimum Payment

- $23,000 Student Loans @ 6.8% – $264 Minimum Payment

- $3,200 Visa @ 12.9% – $66.40 Minimum Payment

- $5,000 Family Loan @ 0% – $100 Minimum Payment

- $16,700 MasterCard @ 22.9% – $485.70 Minimum Payment

First, open up the spreadsheet and enter in all of your debts into the creditor information area. This is what it will look like:

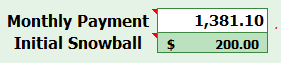

Next, enter in the amount that you will be paying on your debt each month. This will be your minimum payments ($1,181.10) + the extra payment amount ($200) from your budget.

For this example, I’m going to say that there is an extra $200 per month in the budget to assist with debt repayment.

You’ll only enter a number in the “Monthly Payment” box. The “Initial Snowball” number will be calculated automatically. “Initial Snowball” is just another word for the extra payment you’ll be paying on your #1 debt.

Here is what your entry will look like:

Finally, you want to choose a method of getting out of debt from the drop down list.

I’m now going to show you the calculation results based on our example numbers for all three methods. Feel free to skip directly to the method that you’ve chosen.

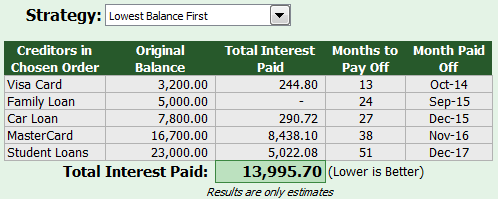

Example Results – Lowest Balance First Method

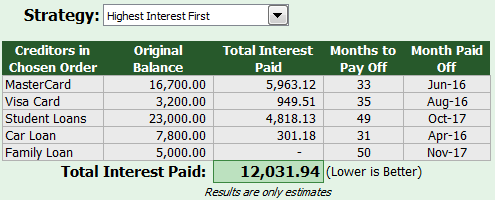

Example Results – Highest Interest First Method

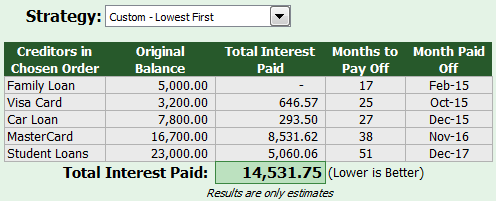

Example Results – Highest Emotional Impact Method

For the highest emotion method, you need to select “Custom – Lowest First”. You’ll also need to manually rank your debts in the “Credit Information Table”. You should have previously ranked them, so just enter the numbers in the “Custom” column.

If you recall, I said that it was decided to pay off the family loan first and then follow the lowest balance method. Here are the rankings based on that scenario:

Here are the results of the calculation:

Comparing The Methods

As you can see, all three methods generated three completely different outcomes.

Lowest Balance First

- 4 years and 3 months to get out of debt

- $13,995.70 in interest will be paid

- 1 year and 1 month until the first debt is paid off

Highest Interest First

- 4 years and 2 months to get out of debt

- $12,031.94 in interest will be paid

- 2 years and 7 months until the first debt is paid off

Highest Emotional Impact

- 4 years and 3 months to get out of debt

- $14,531.75 in interest will be paid

- 1 year and 5 months until the first debt is paid off

And The Winner Is….

Well, that depends.

In terms of interest savings, the highest interest method wins hands down. You save over $1,950 in interest charges over the life of the sample plan compared to the next closest method.

However, with the highest interest method, it will take you over 2 1/2 years before your first debt is paid off. Do you think you’ll fall off the wagon? Will you become frustrated and accumulate more debt that will end up eating away at those savings that you calculated? These are the things that you need to keep in mind.

If you are looking to get “quick wins”, the lowest balance method gets you that. Your first debt will be paid off in only a little over a year. Not bad when you compare it to some other methods.

The emotional impact method ended up being the one with the largest interest expense. That’s mostly because the family loan (at 0% interest) was attacked first. However, if paying that off motivated you to keep with it, you might have ended up better than the other two methods.

Which One Is Best For Your Situation?

That’s the million dollar question.

You may have already made up your mind before seeing the numbers. That’s great.

If you haven’t, maybe you need to evaluate each method to see what the differences are.

Maybe the emotional impact method will get you out of debt in about the same time as the highest interest method and only cost you a few hundred more dollars in interest. You’ll never know until you do the calculation.

Now get out there and take care of your money, so it can take care of you later.

Your financial coach,