Setting Financial Goals For Your Future

To ensure you get the best information, you will find ZERO ads, affiliate links, and sponsored posts on this site. Click here to learn more about my mission.

Setting financial goals is the first step in the 9 Steps to Financial Freedom. I’ve witnessed my clients have significantly more success when they outline the things that are most important to them. Where do you want your money to take you? Setting your financial goals today will help you get there.

Why Are Financial Goals So Important?

Where Do You Want to Go?

Would you go on a cross-country RV trip without making a plan, using a GPS, or looking at the road signs? Of course not!

Being that unprepared would only end in disaster. You would surely get lost or get into an accident.

Similarly, you shouldn’t expect to reach financial freedom safe and sound without a plan.

Financial goals are your road map to financial freedom. They help you determine your destination and keep you from going off track. They also help you find the best way to “reroute” when things change or when you encounter a roadblock.

They’ll Help You Set Discretionary Spending

Dining out, movie nights, and new clothes can be a nice reward for your hard work, but they are not necessary. These types of discretionary expenses are often the reason why people find themselves with few to no savings at the end of the month.

Most of my new clients haven’t set financial goals before. Without financial goals, they have no idea where they want their money to go. So they run the risk of spending more than they should on discretionary expenses.

Setting financial goals helps you establish a destination and create a roadmap to reach it as quickly and safely as possible. That way you can make sure to save money for your goals before you identify how much you can spend on going out and entertainment.

Steps to Setting Financial Goals

Start With a Brain Dump

Before making financial goals, I always recommend doing a brain dump. Brainstorming and writing your ideas down freely will allow you to consider all your financial wants and needs. You may even come up with ideas you would have never thought about before.

So grab a blank piece of paper or a blank whiteboard and write down anything that comes up when you think about money.

What are some things you’ve always wanted to do, but don’t have the money for? How much money do you need to have saved for emergencies to feel safe? How much do you want to spend on presents? Do you want to travel? Anything is fair game!

And you don’t have your brain dump to written sentences. I’ve had clients draw pictures of items they would like to purchase. They’ve also depicted their feelings about money. The important thing is to express all your ideas, feelings, needs, and desires when it comes to money.

If you’re married or in a long-term committed relationship, I recommend splitting up at first. Allow all parties to express themselves freely before coming together and sharing your thoughts. Opposites attract in more ways than one. So if your goals are different, it’s important to ensure all voices are heard before setting official financial goals.

And remember, no goals are off-limits.

Thinking about your financial dreams can be hard if you’re dealing with debt or you’re behind on bills. But it’s important to write down everything you would like to achieve. Let yourself dream and don’t hold back!

You may not be able to achieve some of your goals yet. But you can use these longer-term goals as motivation to resolve your urgent financial issues and take care of your finances in the future.

Define Financial Freedom

Your definition of financial freedom will be the biggest financial goal you will create.

Financial freedom is your ultimate long-term goal. You can think of it as the final destination in your financial journey. All other financial goals will revolve around it, helping to guide you to it.

I have an in-depth article that teaches you how to define financial freedom. But all you need to worry about right now is answering the question, “If money wasn’t an issue, what would I do?”

Take money out of the equation for a minute, and instead focus on your dreams.

Would you move closer to family or spend more time with your children? Maybe you would quit the job that you hate and work at a no-kill animal shelter full-time. Or you may finally take that trip you’ve been dreaming of for years?

Perhaps, you can’t do these things right now because you have debt or your kids are still at home. But that’s what shorter-term goals are for. They’ll help you start down the road towards financial freedom.

You’ll likely go through a few drafts before you arrive at your final definition of financial freedom.

For example, if your initial definition is “I want to not stress about money and be able to spend without guilt,” that might not be your final answer.

You can achieve this goal but still feel trapped. A high-paying job may give you enough money to spend freely, but you may hate the job and the long hours you have to spend at the office.

After each draft, ask yourself, “What would I do next?” If you can come up with more things you want to do, you need to keep editing your definition.

Defining what financial freedom truly means to you is extremely important because you will be comparing all your other financial goals around it. Every time you add a new goal to your list make sure that it will get you closer to not farther from your definition of financial freedom.

Once you’re satisfied, you need to take your definition of financial freedom along with your brain dump and split them into long-term and short-term financial goals.

Long-Term Financial Goals

Your long-term financial goals typically involve more money, so they will take you at least three years to achieve. They’re broad in scope and can be broken down into smaller, short-term goals. This will make it easier to monitor your progress. Each time you achieve one of those short-term goals, you will get closer to your larger goal.

Let’s learn how to create good-quality long-term goals!

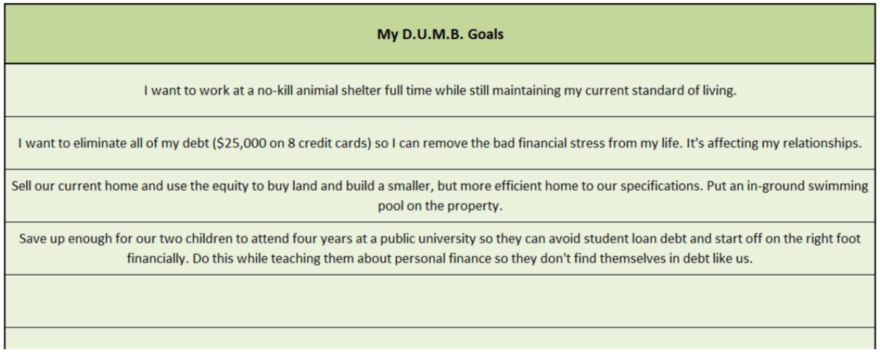

D.U.M.B. Goals

Setting D.U.M.B. long-term financial goals is the smart thing to do. They will help you see the bigger picture and uncover the path you want to take with your finances.

- Dream-driven

Creating goals that are dream-driven will set you on the road toward financial freedom. They may seem impossible in the short term, but you can make them possible in the long term by taking them one day at a time. Get started today, so that instead of regretting not going after your dreams, you’re sure to accomplish something. They do say that you should “Shoot for the moon. And even if you miss, you’ll land among the stars.”

- Uplifting

Your goals should keep you motivated so that you will continue working towards them. Make them something that makes you feel happy and hopeful for the future.

- Method-friendly

Your long-term goals should be able to be broken down into smaller, short-term goals that you can implement into your everyday life.

- Behavior-driven

Write down goals that encourage you to change your behavior in a positive way. After all, the only thing you have complete control over is your own actions. You can’t control the price of food at the supermarket. But you can control whether you stick to your shopping list or spend more money on snacks.

Use your definition of financial freedom to create your first D.U.M.B. goal.

Then you should create several D.U.M.B. goals using the list of ideas you wrote down during your brain dump. Keep in mind that each goal you create here should be easy to break down into smaller, short-term goals.

For example, if your D.U.M.B. goal is “I want to ensure my kids can attend a public university and graduate debt free.” You can break this down into smaller goals, such as, “informing my kids about how much we’re saving for their college funds” and “teaching them what they need to do if they want to go to a private university.”

Check out the “Setting Financial Goals Worksheets” section later in this article for ideas on how to organize your list of goals.

Examples of Long-Term Financial Goals

As mentioned earlier, your long-term financial goals are going to be broad versions of specific goals you might have. On the surface, they sound like they’re going to take forever or are even unattainable. However, you can likely break down your long-term goals into more manageable short-term goals.

Now, let’s take a look at a few examples of long-term financial goals. Please note that these examples are not meant to imply that you need to include them in your list of long-term financial goals. They’re just examples. Your goals will be just that; your goals.

- “I want to work at a no-kill animal shelter full-time while still maintaining my current standard of living.”

- “I want to eliminate all my debt ($25,000 on 8 credit cards) so I can remove the bad stress from my life. It’s affecting my relationships.”

- “Sell our current home and use the equity to buy land and building a smaller, but more efficient home to our specifications. Put in-ground swimming pool on the property.”

- “Save up enough for out two children to attend four years at a public university so they can avoid student loan debt and start off on the right foot financially. Do this while teaching them about personal finance so they don’t find themselves in debt like us.”

As you can see by those examples, they seem very important to the individual. But as they’re currently defined, they can seem quite overwhelming. But you have to write them down. It’s crucial you do. To make them more manageable, you’re going to break them down into more manageable short-term financial goals.

Short-Term Financial Goals

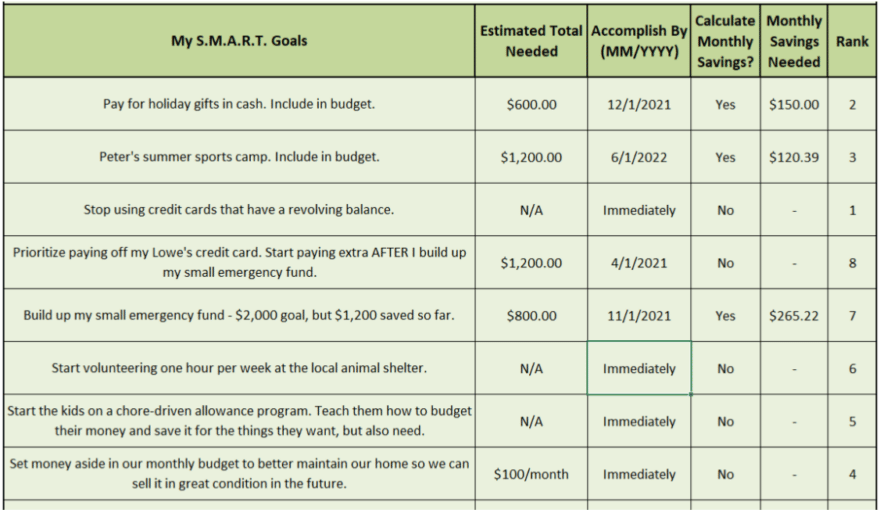

Short-term goals should be achievable in two or fewer years. Some of these will be smaller pieces of your long-term D.U.M.B. goals.

And many others will be unrelated short-term needs and wants. For example, you may need to pay for your kid’s summer camp in full in a few months. Setting that as a short-term goal will help you determine how much you need to save each month to make that payment by the deadline.

I also encourage you to set non-monetary short-term goals. For example, you may want to learn more about finding a financial advisor. Although it won’t cost you any money, it’s related to your finances. So, it’s important to write it down and work to achieve it ASAP.

S.M.A.R.T. Goals

You can break down most of your D.U.M.B.goals into short-term S.M.A.R.T goals.

- Specific

Your short-term should include the specific actions you need to take in order to achieve them. If your long-term D.U.M.B. goal is “to be debt free.” You can set a S.M.A.R.T goal to “pay off your American Express card within 6 months.”

- Measurable

Create goals that are easily tracked so that you can ensure you’re making progress. Going back to the previous example, you can keep a record of your monthly American Express card payment and the amount of debt left.

- Achievable

You should be able to afford to put money towards your goals. Take into account your monthly expenses and other saving plans.

- Relevant

If your S.M.A.R.T goal is a smaller piece of your D.U.M.B. goals, it should be relevant to it. Paying off your credit card is relevant to being debt free. But setting money aside for a trip is not relevant.

- Time-bound

Setting a specific deadline to achieve your goal is important. It will help you figure out how much you need to save or spend every month. And you will help you focus on your goal because you have a set amount of time to achieve it.

Let’s start by taking the long-term goals you created before and decide how you’ll break them down into short-term goals. When you’re done, take a look at your brain dump and identify any leftover goals that can be considered short-term.

Examples of Short-Term Financial Goals

Now, let’s take a look at a few examples of short-term financial goals. Please note that these examples are not meant to imply that you need to include them in your list of short-term financial goals. They’re just examples. Your goals will be just that; your goals. Also, these examples will illustrate how you can break down your long-term goals into more manageable short-term goals.

- “Start volunteering one hour per week at the local animal shelter.”

- “Stop using credit cards that have a revolving balance.”

- “Prioritize paying off my Lowe’s credit card. Start paying extra AFTER I building up my small emergency fund.”

- “Build up my small emergency fund – $2,000 goal, but $1,200 saved so far. This will help me stop accumulating future debt.”

- “Set money aside in our monthly budget to better maintain our home so we can sell it in great condition in the future so we can build our dream home.”

In almost all likelihood, the list of short-term goals would be longer than what’s above. However, you can easily see that these short-term goals are based heavily on the long-term goal examples shown earlier.

Prioritizing Your Financial Goals

Once you’re done creating your long-term and short-term goals, you need to prioritize them. Deciding which goals are more important to you or which goals need to be completed first is an important step in setting financial goals.

Since you only have a set amount of earnings to fund your goals, you need to make sure you’re prioritizing the things that are the most important to you.

Incorporate your goals into your spending and saving plan, so that you can determine how much you can afford to spend on them.

You will have to set aside goals that are not as important or urgent. But that doesn’t mean you will give up on them. You will get to them once you’ve achieved goals that are higher on your priority list.

Setting Financial Goals Worksheet

If you’re looking for an easy way to get your financial goals down on paper, be sure to become a member and gain access to my custom financial goals worksheet.

Here’s a screenshot of the long-term goals section:

Now, here’s a screenshot of the short-term goals section:

For the short-term goals, there’s even a basic calculation built in that will tell you how much you need to save in order to achieve the goal by the month and year you enter.

Here’s how to get a copy of my custom financial goals worksheet:

Financial Goal Tracking

As you start working toward your financial goals, remind yourself of what you’re trying to achieve. It’s also important to recognize that things will inevitably change. You can’t control every aspect of your finances. So as obstacles and unexpected circumstances arise, you’ll need to make adjustments to stay on the road to successfully reaching your goals.

Here are a few last things to remember:

- Your goals aren’t set in stone.

Your priorities may change with time. What was once important to you may no longer be significant. Make sure to regularly update your goals. And make sure to reallocate funds from goals that you’re no longer working towards.

- Your goals are just guesses.

Goals are just guesses. At first, you should focus on setting goals with a purpose and following them. As you get closer to the goal, what you need to do will become clearer. What’s important is starting towards your goals instead of doing nothing.

- You won’t fully achieve all your goals.

It’s okay if you don’t achieve a goal. Working towards it is still important. You may learn more about your finances as you work toward something specific. And don’t let mistakes discourage you, learn from them and adjust accordingly.

Now that you’ve made it this far, get started and take action. Start by brain dumping all your ideas and identifying all your financial goals. And most importantly, find the definition of financial freedom in your life.

Take all the things you’ve learned and set D.U.M.B. long-term goals to determine your financial destination. And break them down into S.M.A.R.T short-term goals to create a roadmap towards success.

And don’t forget to prioritize what’s most important to you. After all, goals are just the tools to give you the freedom to enjoy your life to the fullest

Now get out there and take care of your money, so it can take care of you later.

Your financial coach,